By casting your vote in any of the ways listed above, you are authorizing the individuals listed on the proxy card to vote your shares in accordance with your instructions.

If you have additional questions about this Proxy Statement or the annual meeting or would like additional copies of this document or our

20122015 Annual Report on Form 10-K, please contact: Rodger A. McHargue, Secretary, First Financial Corporation, One First Financial Plaza, P.O. Box 540, Terre Haute, Indiana 47808, (812) 238-6000.

PROPOSAL 1: ELECTION OF DIRECTORS

The

board of directorsBoard as of the

20132016 annual meeting of shareholders will consist of ten members, divided into three classes of approximately equal size that are elected for staggered three-year

terms.The boardterms. The Board believes this structure helps to maintain continuity and stability and ensures we have directors serving on the

boardBoard who have substantial knowledge of the Corporation, all of which the

boardBoard believes facilitates long-term value for our shareholders.

Three directors are to be elected. W. Curtis Brighton, William R. Krieble, and Ronald K.

RichhaveRich have each been nominated for a term of three years and until their respective successors have been elected and qualified. They are all members of the present

board of directors.Board. If, at the time of this annual meeting, any nominee is unable or declines to serve, the discretionary authority provided in the proxy may be exercised to vote for a substitute or substitutes.

Each of the nominees has consented to being named as a nominee in this proxy statement, and is expected to serve if elected. The

board of directorsBoard has no reason to believe that any substitute nominee or nominees will be required.

Name, Age, Principal Occupation(s) and

Business Experience

Nominated for a term expiring in 2016:

|

W. Curtis Brighton,Age 59

|

Mr. Brighton joined the Board in 2004 and is a current member of the Corporation’s Enterprise Risk Management, Loan Review, and Loan Policy and Procedures Committees as well as the Bank’s Loan Committee. Mr. Brighton is the president of Templeton Coal Company, Inc. Prior to this, Mr. Brighton held the positions of president and general counsel for Hulman and Company. Mr. Brighton has been the general manager of Lynch Coal Operators Reciprocal Association since 1985 and was a private practice attorney for 12 years. He serves on the boards of Templeton Coal Company, Inc., Deep Vein Coal Company, Inc., Princeton Mining Company, Inc., R.J. Oil Company, Inc., Union Hospital, Inc. and Lynch Coal Operators Reciprocal Association. Mr. Brighton earned a B.S. degree in Business Administration from Indiana State University and a Doctor of Jurisprudence degree from Drake University.

|

William R. Krieble,Age 65

|

Mr.Krieble joined the Board in 2009 and serves on the Bank’s Loan and Community Reinvestment Act Committees. Mr. Krieble also serves on the Corporation’s Enterprise Risk Management and Affirmative Action Committees. Mr. Krieble retired after 41 years of service to the State of Indiana where he most recently served as the program director for the Division of Disability and Rehabilitative Services of the State of Indiana. He received his B.S. and M.S. degrees from Indiana State University.

|

Ronald K. Rich,Age 74

|

Mr. Rich joined the Board in 2005 and serves as the Chairman of the Governance and Nominating Committee. He is a member of the Corporation’s Compensation and Employee Benefits, Enterprise Risk Management and Audit Committees. Mr. Rich also is a member of the Bank’s Loan Committee. Mr. Rich also serves as the Lead Independent Director. Mr. Rich has been a financial representative for Northwestern Mutual Financial Network since 1963. He holds CLU and CHFC designations from American College. |

Directors whose terms expire in 2015:

|

Thomas T. Dinkel, Age 62

|

Mr. Dinkel joined the Board in 1989 and serves on the Corporation’s Audit and Loan Review Committees. He also serves on the Bank’s Community Reinvestment Act, Investment Services and Loan Committees. Mr. Dinkel has been the president and chief executive officer of Sycamore Engineering, Inc, Dinkel Associates, Sycamore Building Corporation and Dinkel Telekom since 1986 and has held various positions at Sycamore Engineering since 1966. Mr. Dinkel serves on the board of Rose Hulman Institute of Technology and is chairman of the business administration and compensation committees. Additionally, he serves on the facilities, investment management, president evaluation, executive and student affairs committees of the board of Rose Hulman. He earned his B.S. degree from Rose Hulman Institute of Technology.

|

Norman L. Lowery, Age 66

|

Mr. Lowery joined the Board in 1989. He serves on the Corporation’s Acquisition, Affirmative Action, Disaster Recovery, Disclosure, Executive, Enterprise Risk Management, Loan Policy and Procedures, Loan Review and Strategic Planning Committees. Mr. Lowery also serves on the Bank’s Asset Liability and Community Reinvestment Act Committees. Mr. Lowery is the Vice Chairman and Chief Executive Officer of First Financial Corporation, serving since 1996 and 2004 respectively. He is also the President and Chief Executive Officer of First Financial Bank, serving since 1996. Prior to joining First Financial Corporation, Mr. Lowery was a partner in the law firm of Wright, Shagley and Lowery where he practiced for 19 years. Mr. Lowery is a member of the boards of Lynch Coal Operators Reciprocal Association, Indiana State University, the Regional Board of Ivy Tech Community College, the Terre Haute Economic Development Corp. and the Terre Haute Chamber of Commerce. He received a B.S. degree in Political Science from Indiana State University and a Doctor of Jurisprudence degree from Indiana University.

|

William J. Voges, Age 58

|

Mr. Voges joined the Board in 2008 and serves on the Corporation’s Compensation and Employee Benefits, Governance and Nominating Committees as well as the Bank’s Loan Committee. Mr. Voges has served as chief executive officer and chairman of the Root Company since 1996 and as general counsel since 1990. Prior to joining the Root Company, he was a partner in the Fink, Loucks, Sweet, and Voges law firm for 9 years. Mr. Voges also served on the board for Consolidated-Tomoka Land Company (a public company listed on the NYSE-AMEX under the symbol CTO) from 2001 to 2012, where he has served as Chairman from 2009 to 2011, and on the audit, executive and corporate governance committees. He also has prior experience on the boards of several financial institutions. Mr. Voges received his B.S. in Business Administration from Stetson University and his Doctor of Jurisprudence degree from Stetson College of Law.

|

Directors whose terms expire in 2014:

|

B. Guille Cox, Jr., Age 67

|

Mr. Cox has served on the Board of First Financial Corporation since 1987 and is the Chairman of the Bank’s Trust Committee. He also serves on the Bank’s Investment and Loan Committees as well as the Corporation’s Governance and Nominating Committees. Mr. Cox has been a Senior Partner in the Law Firm Cox, Zwerner, Gambill & Sullivan since 1980. He also serves on the boards of Hendrich Title Company and Katzenbach Inc. As a Rose Hulman Institute of Technology board member, Mr. Cox serves on the executive and investment committees. Mr. Cox received a B.S. degree in Physics from MIT and a Doctor of Jurisprudence degree from Harvard Law School.

|

Anton H. George, Age 53

|

Mr. George joined the Board in 1987 and is Chairman of the Corporation’s Audit and Compensation and Employee Benefits Committees. He also serves on the Bank’s Loan Committee. Mr. George is the president of Vision Investments, LLC and Vision Enterprises Global, LLC. Mr. George is the past president and chief executive officer of the Indianapolis Motor Speedway and Hulman and Company. He also is a current director of Vectren Corporation. Mr. George earned a B.S. degree in Business Administration from Indiana State University.

|

Gregory L. Gibson, Age 50

|

Mr. Gibson joined the Board in 1994 and serves on the Corporation’s Loan Review Committee as well as the Bank’s Loan Committee. Mr. Gibson is the president of ReTec, Inc. and serves on the boards of Rose Hulman Institute of Technology and Saint Mary-of-the-Woods College. Mr. Gibson has also served on the Indiana Judicial Commission and is currently serving on the Indiana Port Commission as well as the board of directors for the Methodist Health Foundation in Indianapolis. He holds a B.S. degree from Rose Hulman Institute of Technology.

|

Virginia L. Smith, Age 65

|

Ms. Smith joined the Board in 1987 and serves on the Corporation’s Loan Review, Loan Policy and Procedures, Affirmative Action, and Executive Committees as well as the Bank’s Loan Committee. Ms. Smith has been the president of Princeton Mining Company, Inc. since 1990. She also serves on the boards of Deep Vein Coal Company Inc., Princeton Mining Company Inc., R.J. Oil Company Inc. and the Sheldon Swope Art Museum. Ms. Smith received a B.S. degree in Education from Indiana State University and a B.S. in Business Administration from Saint Mary-of-the-Woods College.

|

Nominated for a term expiring in 2019:

W. Curtis Brighton,Age 62

Mr. Brighton joined the Board in 2004 and is a current member of the Corporation’s Audit, Enterprise Risk Management, Loan Review, and Loan Policy and Procedures Committees as well as the Bank’s Loan Committee. Mr. Brighton is the president of Templeton Coal Company, Inc. Prior to this, Mr. Brighton held the positions of president and general counsel for Hulman & Company. Mr. Brighton has been the general manager of Lynch Coal Operators Reciprocal Corporation since 1985 and was a private practice attorney for 12 years. He serves on the boards of Templeton Coal Company, Inc., Union Hospital, Inc. and Lynch Coal Operators Reciprocal Corporation. Mr. Brighton earned a B.S. degree in Business Administration from Indiana State University and a J.D. degree from Drake University.

William R. Krieble,Age 68

Mr. Krieble joined the Board in 2009 and serves on the Bank’s Loan and Community Reinvestment Act Committees. Mr. Krieble also serves on the Corporation’s Compensation and Employee Benefits, Enterprise Risk Management, Affirmative Action and Cyber Security Committees. Mr. Krieble retired after 41 years of service to the State of Indiana where he most

recently served as the program director for the Division of Disability and Rehabilitative Services of the State of Indiana. He received his B.S. and M.S. degrees from Indiana State University.

Ronald K. Rich,Age 77

Mr. Rich joined the Board in 2005 and serves as the Chairman of the Governance and Nominating Committee. He is a member of the Corporation’s Compensation and Employee Benefits and Enterprise Risk Management Committees. Mr. Rich also is a member of the Bank’s Loan Committee. Mr. Rich also serves as the Lead Independent Director. Mr. Rich has been a financial representative for Northwestern Mutual Financial Network since 1963. He holds Chartered Life Underwriter and Chartered Financial Consultant designations from The American College of Financial Services.

Directors whose term expires in 2017

B. Guille Cox, Jr., Age 70

Mr. Cox has served on the Board since 1987 and serves as the Chairman of the Boards of Directors of the Corporation and the Bank. He also is the Chairman of the Bank’s Trust Committee and serves on the Bank’s Investment and Loan Committees as well as the Corporation’s Governance and Nominating Committee. Mr. Cox has been a senior partner in the law firm of Cox, Zwerner, Gambill & Sullivan LLP since 1980. He also serves on the boards of Hendrich Title Company and Katzenbach Inc. As a Rose Hulman Institute of Technology board member, Mr. Cox serves on the executive and investment committees. Mr. Cox received a B.S. degree in Physics from Massachusetts Institute of Technology and a J.D. degree from Harvard Law School.

Anton H. George, Age 56

Mr. George joined the Board in 1987 and serves on the Corporation’s Audit, Compensation and Employee Benefits, and Executive Committees. He also serves on the Bank’s Loan Committee. Mr. George is the president of Vision Investments, LLC, an import sales and distribution company. Mr. George is the past president and chief executive officer of the Indianapolis Motor Speedway and its parent Hulman & Company. He also serves on the board of directors at Vectren Corporation, a publicly traded energy holding company (NYSE:VVC), and is a member of its Nominating and Corporate Governance and Compensation and Benefits Committees. He also serves on the boards of Princeton Mining Company, Inc., Deep Vein Coal Company Inc. and R.J. Oil Co., Inc. Mr. George earned a B.S. degree in Business Administration from Indiana State University.

Gregory L. Gibson, Age 53

Mr. Gibson joined the Board in 1994 and serves on the Corporation’s Loan Review Committee and the Governance and Nominating Committee as well as the Bank’s Investment and Loan Committees. Mr. Gibson is the president of ReTec Corporation, a waste management consulting business, and is involved in other business ventures. Mr Gibson serves on the board of trustees of Rose-Hulman Institute of Technology and on the board of trustees of Saint Mary-of-the-Woods College. Mr. Gibson has also served on the Indiana Judicial Nominating Commission and is currently serving as vice chairman of the Ports of Indiana Commission as well as the board of directors for the Methodist Health Foundation Inc. in Indianapolis. He holds a B.S. degree from Rose-Hulman Institute of Technology.

Virginia L. Smith, Age 68

Ms. Smith joined the Board in 1987 and serves on the Corporation’s Loan Review, Loan Policy and Procedures, Affirmative Action, and Executive Committees as well as the Bank’s Loan Committee. Ms. Smith has been the president of Princeton Mining Company, Inc., one of our largest shareholders, since 1990 and also serves on its board of directors. She also serves on the boards of Deep Vein Coal Company, Inc., R.J. Oil Co., Inc., Lynch Coal Operators Reciprocal Corporation and the Swope Art Museum, Inc. She is a sister-in-law of Mr. Norman L. Lowery. Ms. Smith received a B.S. degree in Education from Indiana State University and a B.S. in Business Administration from Saint Mary-of-the-Woods College.

Directors whose term expires in 2018:

Thomas T. Dinkel, Age 65

Mr. Dinkel joined the Board in 1989 is the Chairman of the Corporation’s Audit Committee and serves on the Loan Review and Cyber Security Committees. He also serves on the Bank’s Community Reinvestment Act, Investment Services, Operations and Loan Committees. Mr. Dinkel has been the president and chief executive officer of Sycamore Engineering,

Inc., Dinkel Associates, Inc., Sycamore Building Corporation and Dinkel Telekom, Inc. since 1986 and has held various positions at Sycamore Engineering Inc. since 1966. Mr. Dinkel serves on the board of trustees of Rose-Hulman Institute of Technology, and is chairman of its business administration, facilities and compensation committees. Additionally, he serves on the investment management (endowment), president evaluation, executive board of affairs and student affairs committees of the board of Rose-Hulman Institute of Technology. He earned his B.S. degree from Rose Hulman Institute of Technology.

Norman L. Lowery, Age 69

Mr. Lowery joined the Board in 1989 and has served as its Vice Chairman since 1996. He serves on the Corporation’s Acquisition, Affirmative Action, Disaster Recovery, Disclosure, Executive, Enterprise Risk Management, Loan Policy and Procedures, Loan Review, Strategic Planning and Cyber Security Committees. Mr. Lowery also serves on the Bank’s Asset Liability, Community Reinvestment Act and Loan Committees. Mr. Lowery is the Chief Executive Officer and President of the Corporation, serving in those positions since 2004, and 2013 respectively, and the Vice Chairman, President and Chief Executive Officer of the Bank, serving since 1996. Prior to joining the Corporation, Mr. Lowery was a partner in the law firm of Wright, Shagley & Lowery P.C., where he practiced for 19 years. Mr. Lowery serves on the boards of Lynch Coal Operators Reciprocal Corporation, the Terre Haute Area Economic Development Corporation and The Terre Haute Area Chamber of Commerce Inc. He is the brother-in-law of Virginia L. Smith, a current director, and father of Norman D. Lowery, the Chief Operating Officer of the Corporation and the Bank. He received a B.S. degree in Political Science from Indiana State University and a J.D. degree from Indiana University.

William J. Voges, Age 61

Mr. Voges joined the Board in 2008 and is the Chairman of the Corporation’s Compensation and Employee Benefits Committee, and serves on the Governance and Nominating Committee as well as the Bank’s Loan Committee. Mr. Voges has served as chief executive officer and chairman of the Root Company, a private investment company, since 1996 and as general counsel since 1990. Prior to joining the Root Company, he was a partner in the law firm of Fink, Loucks, Sweet & Voges for nine years. Mr. Voges also served on the board for Consolidated-Tomoka Land Co., a publicly traded diversified real-estate operating company (NYSE MKT: CTO), from 2001 to 2012, where he served as Chairman from 2009 to 2011 and on the audit, executive and corporate governance committees. He also has prior experience on the boards of several financial institutions. Mr. Voges received his B.S. in Business Administration from Stetson University and his J.D. degree from Stetson University College of Law.

Recommendation of the Board of Directors

Our board of directors unanimously recommends that you vote “FOR”

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” W. Curtis Brighton, WilliamCURTIS BRIGHTON, WILLIAM R. Krieble, and RonaldKRIEBLE AND RONALD K. Rich, the persons nominated by the Governance and Nominating Committee to be elected as directors.RICH, THE PERSONS NOMINATED BY THE GOVERNANCE AND NOMINATING COMMITTEE TO BE ELECTED AS DIRECTORS.

The Governance and Nominating Committee believes that

well functioningwell-functioning boards consist of a diverse collection of individuals that bring a variety of complementary skills. Although the

board of directorsBoard does not have a formal policy with regard to the consideration of diversity in identifying directors, diversity is one of the factors that the Governance and Nominating Committee may, pursuant to its

committee charter, take into account in identifying director candidates. The Governance and Nominating Committee generally considers each director eligible for nomination in the broad context of the overall composition of our

board of directorsBoard with a view toward constituting a

boardBoard that, as a body, possesses the demonstrated senior leadership and management experience to oversee our business. The Committee has historically sought directors that bring broad and varied skills and knowledge from retail and wholesale businesses, legal, financial and government.

The experience, qualifications, attributes, or skills that led the Governance and Nominating Committee to conclude that each of the members of the

board of directorsBoard nominated by the Governance and Nominating Committee should serve on the

boardBoard are generally described below:

Mr. Brighton’s history as a private practice attorney provides the Board with an enhanced legal and regulatory perspective.

B. Guille Cox, Jr.

Having served on

Mr. Cox’s long-standing tenure provides the Board

of the Corporation since 1987, Mr. Cox provideswith a historical perspective of both the Corporation and the

industry for our Board.industry. His legal practice provides the Board with

counselinsight on legal issues as well as issues in our markets.

As a business owner and an entrepreneur, Mr. Dinkel provides an understanding of small business which makes up much of our lending base. His vast experience as a contractor also provides us with key

insight ininsights concerning our

expansion efforts.facilities and facility maintenance.

Mr. George’s experience on various boards of directors provides valuable advice on governance issues. As an established Midwest entrepreneur, Mr. George has significant knowledge of the markets in which we operate.

As a businessman and entrepreneur

Mr. Gibson hasinvolved in a variety of business

interests. Thisventures, Mr. Gibson provides the Board with invaluable

knowledgeinsight into

these segments ofindustries and markets in which we and our clients

and the markets.do business. As a developer, Mr. Gibson provides counsel

foron market expansion. His service on

Boardsvarious commissions and boards also provides valuable political and governance perspectives.

Mr. Krieble’s long service to the State of Indiana provides the Board with valuable political and governmental perspectives.

As

President and Chief Executive Officer, Mr. Lowery is intimately familiar with

First Financial Corporation, itsour business, our customers and

itsour employees, and

he provides the Board with valuable leadership, particularly through his keen insight into the industry and the markets we serve. His legal background also provides a critical element with respect to governance and regulatory issues affecting the Corporation and the Bank. Mr. Lowery also provides valuable counsel to the Board with respect to our strategic initiatives.

Mr. Rich’s long service in the financial and insurance industries brings specific knowledge of matters affecting the Corporation’s insurance subsidiary and its insurance matters. Mr. Rich also possesses valuable insight regarding our markets and our various client bases.

Ms.

Smith’s service as president of a local retail companySmith provides the Board with valuable insight regarding our market area. Also, as a female business leader, she provides important perspectives on women-owned businesses.

Mr. Voges’ past service on the boards of financial institutions provides additional perspectives of the issues facing our Board. His legal background, coupled with his past experience, provides tremendous value on legal, governance and regulatory matters. Mr. Voges also complements the Board with his keen strategic insight.

ADDITIONAL information about the Board of directorsINFORMATION ABOUT THE BOARD OF DIRECTORS

During the year ended December 31,

2012,2015, the Board

of Directors of the Corporation met

19 times.18-times. Each director attended more than 75% of the aggregate of (i) all meetings of the Board held while he or she was a director and (ii) all meetings of committees on which he or she served during the period that he or she served on the committee. Although the Corporation has no formal policy on director attendance at annual meetings of shareholders, they are encouraged to attend such meetings. All directors attended the

20122015 Annual Meeting of Shareholders.

The Board

of Directors has established a number of committees

whichthat facilitate the administration and oversight of the Corporation. Among these committees are the Governance and Nominating, Audit, and Compensation and Employee Benefits Committees.

Governance and Nominating Committee. Members consist of B. Guille Cox, Jr., Gregory L. Gibson, Ronald K. Rich (Chairman) and William J. Voges. The Board of Directors has determined that Messrs. Cox, Gibson, Rich and Voges are independent under the rules of the NASDAQ Global Select Market. The Governance and Nominating Committee met three timestwice during 2012.2015.

The primary objectives of the Governance and Nominating Committee are to assist the Board of Directors byin developing and recommending corporate governance policies and guidelines for the Corporation and by identifying, evaluating and nominating persons for election to the Board of Directors and appointment to the committees of the Board. A copy of the Governance and Nominating Committee Charter is available on the Corporation’s web site atwww.first-online.com on the “Investor Relations” page under the link “Governance Documents.” The Governance and Nominating Committee identifies director nominees through

a combination of referrals, including referrals from management, existing Board members and shareholders. Other than the director qualifications and independence standards established in our Corporate Governance Guidelines, the Governance and Nominating Committee currently does not maintain any formal criteria for selecting directors and

maywill take into consideration

sucha variety of factors and criteria

as it deems

appropriate.appropriate, with a view toward constituting a Board that possesses the demonstrated senior leadership and management experience to oversee our business. However, in reviewing qualifications for prospective nominees to the Board, the Governance and Nominating Committee generally will take into consideration, among other matters, a candidate’s experiences, skills, expertise, diversity, personal and professional integrity, character, business judgment, time available to serve, dedication, conflicts of interest and ability to oversee the Corporation’s business and affairs. The Governance and Nominating Committee does not evaluate nominees proposed by shareholders any differently than other nominees to the Board.

Audit Committee. Members consist of Anton H. George (Chairman),W. Curtis Brighton, Thomas T. Dinkel (Chairman) and Ronald K. Rich.Anton H. George. The Board of Directors has determined that Messrs. George,Brighton, Dinkel and RichGeorge are independent under SECSecurities and Exchange Commission ("SEC") Rule 10A-3 and the rules of the NASDAQ Global Select Market. The Audit Committee met 4four times during 2012.2015.

The primary objectives of the Audit Committee are to assist the Board

of Directors in its oversight of the following matters:

| · | The integrity of our financial statements. |

| · | The qualifications and independence of our independent registered public accounting firm. |

��

| · | The performance of our internal audit function and independent registered public accountants. |

| · | Our compliance with certain applicable legal and regulatory requirements. |

| · | Our system of disclosure controls and system of internal controls regarding finance, accounting and legal compliance. |

The integrity of our financial statements;

The qualifications and independence of our independent registered public accounting firm;

The performance of our internal audit function and independent registered public accountants;

Our compliance with certain applicable legal and regulatory requirements; and

Our system of disclosure controls and system of internal controls regarding finance, accounting and legal compliance.

In addition, among other responsibilities, the Audit Committee reviews the Corporation’s accounting functions, the adequacy and effectiveness of the internal controls and internal auditing methods and procedures. A copy of the Audit Committee charter is available on the Corporation’s website atwww.first-online.com on the “Investor Relations” page under the link “Governance Documents.” The Board

of Directors has determined that each member of the Audit Committee is financially sophisticated under the applicable NASDAQ rules. The Board

of Directors selected the members of the Audit Committee based on the Board’s determination that they are fully qualified to monitor the performance of management, the public disclosures by the Corporation of its financial condition and performance, our internal accounting operations and our independent registered public accountants. In addition, the Audit Committee has the ability on its own to retain independent accountants or other advisors whenever it deems appropriate.

The Board of Directors has determined that none of its members currently meets the Corporation currently does not have a director who qualifies as a “financialdefinition of an “audit committee financial expert” under federal securities laws. To be considered a “financialan “audit committee financial expert,” an individual’s past experience generally mustshould include experience in the preparation or audit of comparable public company financial statements, or the supervision of someone in the preparation or audit of comparable public company financial statements. While it might be possible to recruit a person who meets these qualifications of a “financial expert,” theThe Board has determined that in order to best fulfill all the functions of our Board and our Audit Committee, each member of ourthe Board and ourthe Audit Committee including any “financial expert,” should ideally understand community banking and understand the local markets in which the Corporation operates, and the Bank

do business. Accordingly, potential candidates who have such attributes in addition to having the experience the Board believes is necessary to qualify as “audit committee financial experts” are limited. Further, the Board believes that

itthe addition of an “audit committee financial expert” is not

innecessary at this time given the

best interestslevel of

our Corporation to nominate as a director someone who does not have allfinancial knowledge and experience the

experience, attributes and qualifications we seek.current members of the Audit Committee possess.

Compensation and Employee Benefits Committee.Members Members consist of Anton H. George, (Chairman),William R. Krieble, Ronald K. Rich, and William J. Voges.Voges (Chairman). The Board of Directors has determined that Messrs. George, Krieble, Rich and Voges are independent under the rules of the NASDAQ Global Select Market. The Compensation and Employee Benefits Committee met 3five times in 2012.during 2015.

The primary objective of the Compensation and Employee Benefits Committee is to review and approve the Corporation’s compensation strategy and the compensation of our named executive officers and senior management. In addition, among other responsibilities, the Compensation and Employee Benefits Committee administersestablishes guidelines and oversees the administration of executive compensation plans of the Corporation.and arrangements, as well as certain employee benefit plans. A copy of the charter of the Compensation and Employee Benefits Committee is available on the Corporation’s website atwww.first-online.com on the “Investor Relations” page under the link “Governance Documents.” Compensation of Directors

The goal of our director compensation package is to attract and retain qualified candidates to serve on the

Board of Directors.Board. In setting compensation, the Board considers compensation levels of directors of other financial institutions of similar size. Each director of the Corporation is also a director of First Financial Bank, N.A. (the “Bank”), the lead subsidiary bank of the Corporation. The non-employee directors receive director fees from both the Corporation and the Bank. During

2012,2015, nonemployee directors received a

$40,000.00$40,000 retainer from the Corporation and a

$5,000.00$5,000 retainer from the Bank. During

2012,2015, each non-employee director of the Corporation and the Bank received a fee of $750 for each board meeting attended for the Corporation

andor the

Bank, respectively.Bank. In addition, Mr. Cox received a fee of $5,000 in connection with his services as Chairman of the Board.

Non-employee directors also receive a fee for each meeting attended of the Audit Committee of $1,000, the Compensation and Employee Benefits Committee of $1,000, the Governance and Nominating Committee of $500 and the Loan Committee of the Bank of

$300.$500. No non-employee director served as a director of any other subsidiary of the Corporation.

Employee directors receive no compensation for their service on the boards or board committees of the Corporation and the Bank.

The table below summarizes the compensation paid by the Corporation to each non-employee director for the fiscal year ended December 31,

2012.2012 2015.

DIRECTOR COMPENSATION

TABLE| | | | | | | | | | |

| | | Fees Earned or | | | | | | | |

| Name | | Paid in Cash | | | | | | Total | |

| | | | | | | | | | | | | |

| W. Curtis Brighton | | $ | 75,000 | | | | (1 | ) | | $ | 75,000 | |

| B. Guille Cox | | | 76,600 | | | | | | | | 76,600 | |

| Thomas Dinkel | | | 79,300 | | | | | | | | 79,300 | |

| Anton H. George | | | 79,600 | | | | | | | | 79,600 | |

| Gregory L. Gibson | | | 72,600 | | | | | | | | 72,600 | |

| William H. Krieble | | | 75,600 | | | | (1 | ) | | | 75,600 | |

| Ronald K. Rich | | | 82,700 | | | | | | | | 82,700 | |

| Virginia L. Smith | | | 81,300 | | | | | | | | 81,300 | |

| William J. Voges | | | 79,300 | | | | (1 | ) | | | 79,300 | |

| (1) | Members of the Board of Directors have the ability to defer a portion of their director fees under the First Financial Corporation 2005 Directors’ Deferred Compensation Plan. For a more detailed discussion of this plan, see the narrative immediately following these footnotes. |

|

| | | | | | | | | | |

| | | Fees Earned or | | | | |

| Name | | Paid in Cash | | | | Total |

| W. Curtis Brighton | | $ | 82,500 |

| | | | $ | 82,500 |

|

| B. Guille Cox | | 84,000 |

| | | | 84,000 |

|

| Thomas Dinkel | | 83,000 |

| | | | 83,000 |

|

| Anton H. George | | 84,000 |

| | | | 84,000 |

|

| Gregory L. Gibson | | 77,500 |

| | | | 77,500 |

|

| William H. Krieble | | 81,000 |

| | | | 81,000 |

|

| Ronald K. Rich | | 82,000 |

| | | | 82,000 |

|

| Virginia L. Smith | | 77,500 |

| | | | 77,500 |

|

| William J. Voges | | 82,000 |

| | | | 82,000 |

|

First Financial Corporation Directors’ Deferred Compensation Plan. Directors Prior to 2011, directors of the Corporation and the Bank maywere permitted to participate in the First Financial Corporation 2005 Directors’ Deferred Compensation Plan.a directors’ deferred compensation plan. Under thisthe plan, a director maycould elect to defer up to $6,000 of his or her director’s fees each year over a five-year period provided that the director timely submits a deferral election to the Corporation.period. The amount of deferred fees iswas used to

purchase an insurance product, of which the Corporation is the beneficiary, that funds benefit payments. An amount equal to the face amount of the policy,

will be paid to the director in addition to an amount equal to the tax savings the Corporation will receive by obtaining the proceeds from the policy on a tax-free

basis.basis, will be paid to the director or his or her beneficiary. Payment will be made to the director

or his or her beneficiary in 120 monthly installments beginning on the first day of the month after the earlier of the director’s 65th birthday or death. Each year from the initial date of deferral until payments begin, the Corporation accrues a non-cash expense, which will equal, in the aggregate, the amount of the payments to be made to the director over the ten-year period.

If a director fails for any reason, other than death, to serve as a director during the entire five-year period, or the director fails to attend at least 12 regular or special meetings of the Board each year, the amount of benefits paid will be prorated appropriately. For

2012,2015, the allocated cost of the deferred directors’ fees was

$141,680.76.$142,416. This plan was closed to new participants in 2011. During 2015, no directors deferred amounts under this plan, and those directors who have attained age 65 received payments attributable to previously-deferred amounts under the plan in the following amounts: Mr. Dinkel - $27,000, Mr. Krieble - $10,363, Mr. Norman L. Lowery - $118,930 and Ms. Smith - $74,914.

Director Stock Ownership Guidelines

The Board

of Directors believes that directors more effectively represent the Corporation’s shareholders

whose interests they are charged with protecting, if they are shareholders themselves. Therefore, the Board has adopted

director stock ownership guidelines applicable to all

directors. All directors,

are requiredother than Norman L. Lowery, who is subject to

the stock ownership guidelines for executive officers discussed under “Compensation Discussion and Analysis.” Under the guidelines, directors must own a number of shares of the Corporation’s common stock equal in value to three times their annual Corporation retainer for services as a director.

Additionally, directors may not dispose of shares of Corporation stock until they have satisfied the guidelines. Directors are expected to

complybe in compliance with the

stock ownership guidelines

as soon as practicable and in no eventnot later than five years after the date of their initial election or appointment as a director of the Corporation. In the case of individuals who were directors when the

current guidelines became effective, compliance is required

within five yearsby February 21, 2017. Presently, eight of

the effective date. Additionally,our nine non-employee directors

may not dispose of shares of Corporationhave met their stock

until they have satisfied theownership levels under these guidelines.

Hedging and similar monetization transactions by a director or an executive officer can lead to a misalignment between the objectives of that director or executive officer and the objectives of our shareholders. Accordingly, all directors, officers and employees are prohibited from engaging in hedging or monetization transactions with respect to the securities of the Corporation.

Compensation Committee Interlocks and Insider Participation

During

2012 and as of the date of this Proxy Statement,2015 none of the members of the Compensation and Employee Benefits Committee was or is an officer or employee of the Corporation, and no executive officer of the Corporation served or serves on the compensation committee (or

other board committee performing equivalent functions or, in the absence of any

othersuch committee,

orthe entire board of

directors) or on the board of directors

performing a similar function) of any company that employed or employs any member of the Corporation’s Compensation and Employee Benefits

CommitteeCommittee. In addition, no executive officer of the Corporation served or

serves on the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any company one of whose executive officers serves on our Board,

except for Norman D. Lowery, the Chief Operating Officer, who is a member of

Directors.the board of directors of Princeton Mining Company, Inc., for which Virginia Smith, one of our directors, serves as President.

Certain Relationships and Related Transactions

Certain family relationships exist among the directors and executive officers of the Corporation.

Donald E. Smith (the Chairman of the Board and President of the Corporation) is the father of Virginia L. Smith (a director of the Corporation), and is the father-in-law of Norman L. Lowery (the Vice Chairman,

President, and Chief Executive Officer of the Corporation and the

President and Chief Executive Officer of First Financial Bank)

andis the

grandfatherfather of Norman D. Lowery (the Chief Operating Officer of

First Financial Bank N.A.). Norman D. Lowery is also the

sonCorporation and the Bank) and the brother-in-law of

NormanVirginia L.

Lowery.Smith (a director of the Corporation and the Bank). There are no arrangements or understandings between any of the directors and executive officers pursuant to which any of them have been selected for their respective positions.

The Audit Committee is responsible for approving any transactions between the Corporation or its subsidiaries and any related party, including loans or extensions of credit and any sale of assets or other financial transactions. Directors and executive officers of the Corporation and their associates were customers of, and have had transactions with, the Corporation and its subsidiaries in the ordinary course of business during 2012.2015. Comparable transactions may be expected to take place in the future. During 2012,2015, various directors and executive officers of the Corporation and their respective associates were indebted to the subsidiary banks from time to time. These loans were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for similar transactions with other persons not related to the Corporation and did not involve more than the normal risk of collectability or present other unfavorable

features. Loans made to directors and executive officers

that are

in compliance withsubject to federal banking regulations

and thereby are exempt from the insider loan prohibitions included in the Sarbanes-Oxley Act of 2002.

Related party transactions are evaluated on a case-by-case basis in accordance with the applicable provisions of the Articles of Incorporation and the Code of Business Conduct and Ethics of the

Corporation.Corporation (the “Code of Ethics”).

The provisions of the Articles of Incorporation apply to contracts or transactions between the Corporation and (i) any director; or (ii) any corporation, unincorporated association, business trust, estate, partnership, trust, joint venture, individual or other legal entity in which any director has a material financial

interest.interest or of which any director is a director, officer or trustee. The provisions of the Code of

Business Conduct and Ethics apply to the directors, officers and employees of the Corporation.

The Articles of Incorporation provide that

contractsa contract or

transactionstransaction between the Corporation and any of the persons described above

areis valid for all purposes, if the material facts of the contract or

transactionstransaction and the director’s interest were disclosed or known to the Board,

of Directors, a committee of the Board

of Directors with authority to act thereon, or the shareholders entitled to vote thereon, and the Board,

of Directors, such committee or such shareholders authorized, approved or ratified the contract or transaction.

The Code of

Business Conduct and Ethics provides that directors, officers and employees of the Corporation must make business decisions for the Corporation free of conflicting influences. Such persons are expected to avoid situations that may lead to real or apparent material conflicts between such person’s

self interestself-interest and

theirsuch person’s duties or responsibilities as a director, officer or employee of the Corporation.

The Senior Compliance Officersenior compliance officer is responsible for annually reaffirming compliance with the Code of Business Conduct and Ethics by the directors, officers and employees of the Corporation.

During 2012, Platolene 500, Inc., an indirect subsidiary

INFORMATION ABOUT THE NAMED EXECUTIVE OFFICERS

The name, age, position and business experience of Deep Vein Coal Company, Inc., received payments for providing fuel and services to First Financial Bank N.A. in the amount of approximately $196,005.06. Donald E. Smith (the Chairmaneach named executive officer who is not a member of the Board and President ofis described below:

Rodger A. McHargue, Age 54

Mr. McHargue is the Corporation) is a Director and Chairman of Platolene 500. Virginia L. Smith (the daughter of Mr. Smith and a director of the Corporation), and Sarah J. Lowery, the daughter of Mr. Smith and wife of Norman L. Lowery (the Vice Chairman and Chief ExecutiveFinancial Officer of the Corporation)Corporation and the Bank and also the Secretary and Treasurer of the Corporation, serving since 2010. He joined the Corporation in 1994. Prior to that, Mr. McHargue was employed at Bank One Indianapolis for over six years. He received a B.S. degree in Economics and Finance from Indiana State University and an M.B.A. from Indiana State University. He is also a graduate of the ABA Stonier Graduate School of Banking.

Steven H. Holliday, each ownAge 55

Mr. Holliday is the Chief Credit Officer of the Corporation and the Bank, serving since 2012. Prior to joining the Corporation, Mr. Holliday was a 27% equity interest in Deep Vein Coal Company, Inc. and serve asSenior Vice President and Commercial Lending Executive at Old National Bancorp. Mr. Holliday received his B.S. in Business from Indiana State University and an M.B.A. from the University of Illinois. He holds a Credit Risk Certification designation through The Risk Management Association and is a graduate of Southern Illinois University School of Banking.

Norman D. Lowery, Age 48

Mr. Lowery is the Chief

OperatingOperations Officer

of the Corporation and

Vice President, respectively,the Bank, serving since 2010. He joined the Corporation in 1990 and has held a management position in Private Banking, as well as having been a Trust Investment Officer. Mr. Lowery received his B.A. degree from Indiana University and M.B.A. from Indiana Wesleyan University. Mr. Lowery holds several professional accreditations, including, a Financial Industry Regulatory Authority Series 7 license; Uniform Securities Agent Series 63 license; and a Uniform Investment Adviser Series 65 license. He is also an Accredited Investment Fiduciary and is a licensed life insurance agent in the State of

Platolene 500, Inc.Indiana. Mr. Lowery also graduated from the ABA Stonier Graduate School of Banking.

Karen L. Milienu, Age 55

Ms. Milienu is the Director of Branch Banking for the Bank, serving since 2011. She joined the Corporation in 1997 and served as the Human Resources Director. Prior to joining the Corporation Ms. Milienu held positions as an Assistant Manager and various human resources positions at Fort Wayne National Corporation. Ms. Milienu received her B.A. degree from Purdue University and M.S. degree from Indiana University. Ms. Milienu holds several professional accreditations including, Senior Professional in Human Resources, Certified Compensation Professional, Certified Sales/Management Development Trainer, and Certified Sales Trainer.

The Corporation aspires to the highest ethical standards for its employees, officers and directors and remains committed to the interests of its shareholders. The Corporation believes it can achieve these objectives with a plan for corporate governance that clearly defines responsibilities, sets high standards of conduct and promotes compliance with the law. The Board

of Directors has adopted policies and procedures designed to foster the appropriate level of corporate governance. Certain of these

policies and procedures are discussed below.

Consideration of Director Candidates

The Board

of Directors seeks directors who represent a variety of backgrounds and experiences

whichthat will enhance the quality of the Board’s deliberations and decisions. When searching for new candidates, the Governance and Nominating Committee considers the evolving needs of the Board and searches for candidates who will fill any current or anticipated gaps. The Governance and Nominating Committee generally considers, among other matters, a candidate’s

experiences,experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time available to serve, dedication, conflicts of interest and ability to oversee the Corporation’s business and affairs. The Governance and Nominating Committee does not have a formal diversity policy; however, both the Board and the Governance and Nominating Committee believe it essential that Board members represent diverse experiences and viewpoints. The Governance and Nominating Committee considers the entirety of each candidate’s credentials. With respect to directors who are nominated for re-election, the Governance and Nominating Committee also considers such director’s previous contributions to the Board.

Board Leadership Structure and Lead Independent Director

Our Board

of Directors regularly reviews and assesses the effectiveness of our leadership structure and will implement any changes as it deems appropriate. In February 2013, the Board

of Directors established the size of the Board at

10,ten, effective as of the 2013 annual meeting of shareholders.

Our

We have determined our Chairman of the Board

also serves as ourto be independent. Our President and

our Chief Executive Officer is also a director. The Board has separated the roles of Chief Executive Officer and Chairman of the Board in recognition of the differences between the two roles. The Chief Executive Officer is responsible for setting the strategic direction for the Corporation and the day-to-day leadership and performance of the Corporation, while the Chairman provides guidance to the Chief Executive Officer and sets the agenda for

Board meetings and presides over

meetings of the full Board.Board meetings.

Eight of our Directors are considered independent under the requirements of the NASDAQ Global Select Market. The Board

of Directors has appointed the Chairman of our

Governance and NominatingCommittee, Ronald K. Rich, to serve as our lead independent directorLead Independent Director to preside at all meetings of the independent directors. As lead independent director,Lead Independent Director, Mr. Rich acts as a liaison between the Board and the Chief Executive Officer. He also develops the agendas for the executive sessions. The independent directors met four times during 2012.2015.

We believe that the separate responsibilities of, and coordination between, our Chairman, Chief Executive Officer and our

lead independent directorLead Independent Director enhances our

Board of Directors’Board's oversight of communications with our shareholders and is an effective leadership structure for our circumstances. Our Board

of Directors also believes that the separately defined roles of the Chairman, Chief Executive Officer and

lead independent directorLead Independent Director provide for effective corporate governance and enable the Chief Executive Officer to focus his time and energy on operating and managing the Corporation while leveraging the experiences and perspectives of the Chairman and Lead Independent Director.

We recognize that no single leadership model is right for all companies and at all times.

Risk Oversight

Our Board

recognizes that, depending on the circumstances, other leadership models might be appropriate at some point and our Board of Directors periodically reviews its leadership structure in this regard.Risk Oversight

Our Board of Directors has an active role, as a whole and also at the committee level, in overseeing management of the Corporation’s risks. The Board regularly reviews information regarding the Corporation’s financial results, operations and liquidity, as well as the risks associated with each.

The Audit Committee oversees management of the Corporation’s financial risks, including the oversight of our internal audit function and potential conflicts of interest. The Compensation and Employee Benefits Committee is responsible for overseeing the management of risks relating to the Corporation’s executive compensation plans and arrangements. The Governance and Nominating Committee manages risks associated with the independence of the Board of Directors. Board.

The Director’s Enterprise Risk Management Committee advises and assiststhe Enterprise Risk Management Committee advise and assist the Board in its oversight and management of enterprise risk. The Enterprise Risk Management Committee is comprisedcomposed of Board members W. Curtis Brighton, William R. Krieble and Ronald K. Rich, the Chief Executive Officer, the Chief Operating Officer, the Chief Financial Officer, the Chief Credit Officer, Chief Risk Officer, the Chief Compliance Officer, the Director of Branch Banking, the heads of Legal, Operations, Human Resources, Loan Review, Auditing, Information Technology, a Senior Attorney, the Security Officer, the Chief Information Security Officer, an IT Cyber Security Analyst, and representatives from our subsidiaries The Morris Plan Company of Terre Haute and Forrest Sherer Insurance.Inc. The Director’s Enterprise Risk Management Committee is composed of Board members W. Curtis Brighton (Chairman), William R. Krieble, and Ronald K. Rich, who are responsible for, among other matters, coordinating risk management issues with other Board and management level committees as well as establishing and maintaining effective policies, procedures and practices for identifying, measuring and mitigating enterprise risk. The Enterprise Risk Management Committee receivesand the Director’s Enterprise Risk Management Committee receive regular reports from management and meetsmeet no less frequently than quarterly to discuss matters relating to the management of the various components of enterprise risk, including credit, interest rate, liquidity, compliance, technology, transaction, reputation and strategic risks.

The Corporation’s and the Bank’s Cyber Security Committees evaluate and oversee the management of risks relating to our information technology infrastructure. The Corporation’s and the Bank’s CRA Committees evaluate and oversee the management of risks relating to our compliance with the Community Reinvestment Act. The Bank’s Fair Lending Committee evaluates and oversees the management of risks relating to our lending policies and practices.

While each committee is responsible for evaluating certain risks and overseeing the management of these risks, the entire Board

of Directors is regularly informed about such risks through committee reports.

The Board

of Directors has determined that a majority of the members of the Board, including Messrs. Cox, Krieble, Rich, George, Dinkel, Voges, Brighton and Gibson, are independent, as independence is defined under revised listing standards of the NASDAQ Global Select Market applicable to the Corporation.

Corporate Governance Guidelines

The Board

of Directors has adopted Corporate Governance Guidelines containing general principles regarding the functions of the Board

of Directors and its committees. The Governance and Nominating Committee periodically reviews the Corporate Governance Guidelines and will recommend changes to the Board as it deems appropriate. A copy of the Corporate Governance Guidelines is available on the Corporation’s web site atwww.first-online.com

on the “Investor Relations” page under the link “Governance Documents”.The Board

of Directors has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of the Corporation’s directors, officers and employees, including its principal executive officer, principal financial officer, principal accounting officer and controller. The Corporation intends to disclose any amendments to the Code of Ethics by posting such amendments on its website. In addition, any waivers of the Code of Ethics for directors or executive officers of the Corporation will be disclosed in a report on Form 8-K filed with the

Securities and Exchange Commission.SEC. A copy of the Code of Ethics is available on the Corporation’s web site atwww.first-online.com

on the “investor“Investor Relations” page under the link “Governance Documents”.Communications with

Independent Directors

Any shareholder who desires to contact the Chairman of the Board,

of Directors, the Lead Independent Director or the other members of the Board,

of Directors, or who desires to make a recommendation of a director candidate for consideration by the Governance and Nominating Committee, may do so electronically by sending an email to the following address: directors@ffc-in.com. Alternatively, a shareholder can contact the Chairman of the Board, Lead Independent Director, Chairman of the Governance and Nominating Committee or the other members of the Board by writing to: First Financial Corporation, One First Financial Plaza, P.O. Box 540, Terre Haute, Indiana 47808.

The Governance and Nominating Committee will consider any candidate submitted by a shareholder in the manner described above. Communications received electronically or in writing are distributed to the Chairman of the Board, Lead Independent Director, Chairman of the Governance and Nominating Committee or the other members of the Board as appropriate depending on the facts and circumstances outlined in the communication received. For example, if any complaints regarding accounting, internal accounting controls and auditing matters are received, then they will be forwarded by the Secretary to the Chairman of the Audit Committee for review.

For further information, including electronic versions of our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Audit Committee Charter, Compensation and Employee Benefits Committee Charter, and Governance and Nominating Committee Charter, please contact the Secretary of the Corporation, Rodger A. McHargue, First Financial Corporation, One First Financial Plaza, P.O. Box 540, Terre Haute, Indiana 47808, (812) 238-6000, or visit our website atwww.first-online.com on the “Investor Relations” page under the link “Governance Documents.”REPORT OF THE

In accordance with its written charter adopted by the Board,

of Directors, the Audit Committee of the Board assisted the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Corporation.

All of the members of the Audit Committee are independent, as defined in the Corporation’s listing requirements. During

2012,2015, the Audit Committee met

4four times, and the Audit Committee chair, as representative of the Audit Committee, discussed the interim financial information contained in each quarterly earnings announcement with management and the independent

auditorspublic accounting firm prior to public release.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent

auditorspublic accounting firm a formal written statement describing all relationships between the

auditorsindependent public accounting firm and the Corporation that might bear on the

auditors’independent public accounting firm’s independence consistent with

Independence Standardsapplicable requirements of the Public Company Accounting Oversight Board

Standard No. 1, “Independence Discussions(United States) regarding the independent public accounting firm’s communications with

the Audit

Committees,”Committee concerning independence, and has discussed with the

auditorsindependent public accounting firm any relationships that may impact

theirthe independent public accounting firm's objectivity and independence and satisfied itself as to the

auditors’independent public accounting firm’s independence. The Audit Committee also discussed with management, the internal auditors and the independent

auditorspublic accounting firm the quality and adequacy of the Corporation’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Audit Committee reviewed both with the independent and internal auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent

auditorspublic accounting firm all communications required by

generally accepted auditing standards

of the Public Company Accounting Oversight Board, including

those described in Statement onthe matters required to be discussed by Auditing

StandardsStandard No.

61, as amended,16, “Communication with Audit Committees,” and, with and without management present, discussed and reviewed the results of the independent

auditors’public accounting firm’s examination of the financial statements. The Audit Committee also discussed the results of the internal audit examinations.

The Audit Committee reviewed and discussed the audited financial statements of the Corporation as of and for the year ended December 31,

2012,2015, with management and the independent

auditors.public accounting firm. Management represented to the Audit Committee that the Corporation’s financial statements as of and for the year ended December 31, 2015 were prepared in accordance with accounting principles generally accepted in the United States. Management has the

primary responsibility for the preparation of the Corporation’s

internal controls and financial statements and the independent

auditors havepublic accounting firm has the responsibility for

performing an independent audit of our consolidated financial statements in accordance with the

examinationstandards of

those statements.the Public Company Accounting Oversight Board.

Based on the above-mentioned review and discussions with management and the independent

auditors,public accounting firm, the Audit Committee recommended to the Board that the Corporation’s audited financial statements be included in its

2015 Annual Report on Form 10-K for

the year ended December 31, 2012, for filing with the

Securities and Exchange Commission.SEC. |

| |

| | Members of the Audit Committee |

| |

| Thomas T. Dinkel, Chairman |

| | Anton H. George Chairman |

| | Thomas T. Dinkel |

| Ronald K. RichW. Curtis Brighton |

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS

Summary

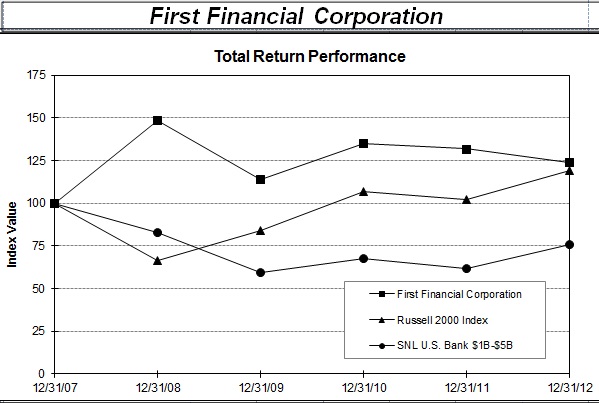

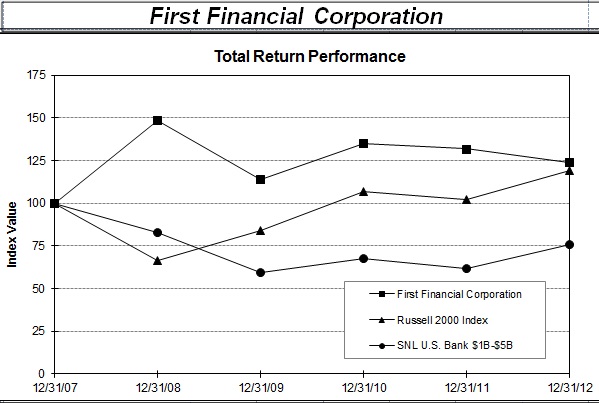

5 Year Shareholder Return.

EXECUTIVE SUMMARY

2015 Financial Performance

Economic growth in most of the markets in which we do business continued to be sluggish during 2015, as there was little population or business growth and unemployment rates continued above state and national averages. Notwithstanding the challenges presented by these headwinds, we had another year of good overall financial performance by continuing our steady, disciplined approach. Our 2015 performance included:

Increased annual dividends to our shareholders for the 27th consecutive year;

Net income of $30.2 million compared to $33.8 million for 2014, due in part to higher pension expense attributable to changes in actuarial and interest rates or assumptions;

Total loans at year-end of $1.76 billion, down slightly from $1.78 billion at year-end 2014;

Strong asset quality, as non-performing loans at year end were 1.44% of total loans, down from 1.76% at the end of 2014;

Increase of 5.45% in book value per share to $32.21 at year end from $30.46 at year end 2014;

Growth of 0.35% in shareholders’ equity to $404.5 million; and

Completion of our $21.6 million stock repurchase program, which returned $8.0 million to shareholders in 2015.

2015 Compensation Decisions

Based on this performance, our Compensation and Employee Benefits Committee made the following decisions concerning the compensation of our CEO and other named executive officers.

Base Salaries.We made modest base salary increases in 2015, in line with our company-wide salary increase budget of approximately 3%. However, as he did in 2014, our CEO again recommended that his salary increase be limited to free up part of the salary increase budget for merit raises elsewhere in the organization. As a result, our CEO received a base salary increase of less than 2%.

Short-Term Incentive Compensation. Under our short-term incentive compensation plan (“STIP”), we used six Corporation-wide performance measures - net income, efficiency ratio, non-performing loans, delinquencies, loan growth, and deposit growth - to assess performance of our CEO. For our other NEOs, bank and controllable departmental measures were used in place of the loan quality measures where appropriate. As shown in the table on pages 21-22, the combination of below target performance on each of the income, expense, loan and deposit metrics, and above target results in the asset quality measures, resulted in below target STIP payouts for our CEO and other NEOs, except our chief credit officer, Mr. Holliday.

Long-Term Incentive Compensation. We make awards under our long-term equity incentive plan (“LTIP”) in February of each year to our CEO and other NEOs based how we have performed against certain performance measures over the prior three-year period. For performance through 2014, we used four measures - return on assets, return on equity, tangible book value and earnings per share (“EPS”) - to assess performance. We made awards in February 2015 based on performance through 2014. As discussed in the proxy statement for last year’s meeting, our February 2015 awards reflected slightly above-target performance in each of these categories. We continued to use these performance measures in 2015. As shown in the table on page 23, we achieved performance at or just above target in each of these categories over the three-year period ending in December 2015, resulting in LTIP awards of approximately 101% of target in February 2016.

2015 CEO Compensation

The graph below representstotal direct compensation (base salary, STIP and LTIP) of our CEO for 2015 was less than his total direct compensation in 2014 and his 2014 total direct compensation was less than his 2013 total direct compensation. This trend in our CEO’s total direct compensation aligns with our overall flat to slightly down financial performance in those years as measured against our goals.

Notwithstanding the five-yeardecline in total returndirect compensation, the 2015 and 2014 total compensation of our CEO reported in the Summary Compensation Table on page 25 is higher than the total compensation reported for 2013. The higher amount is due entirely to the reporting of the year-to-year increase in the actuarial value of accumulated retirement benefits under our long-standing pension plans. The increase is primarily attributable to our CEO’s continued service and the impact of changes in interest rates and mortality assumptions. The reported change in present value is not a current cash payment, nor does it represent incremental compensation awarded to our CEO by the Committee in either of those years.

Pay-for-Performance Pay Practices

We continue to maintain the following pay practices, which we believe enhance our pay-for-performance philosophy and further align our executives’ interests with those of our shareholders: |

| | |

| WE DO HAVE THIS PRACTICE | | WE DO NOT HAVE THIS PRACTICE |

Tie a significant portion of executive compensation, over 50% in the case of our CEO, to our performance metrics in the form of “at-risk” compensation. Incentive award metrics that are objective and tied to key company performance metrics. Grant equity awards based on performance and vest those equity awards over three years to promote retention Compensation recoupment “claw-back” policy. Anti-hedging policy. Double trigger change in control severance. Share ownership guidelines (for executives and directors). | | Non-performance based incentive awards. Hedging transactions by executive officers or directors. Excise tax gross-ups in our employment agreements. Automatic renewal (“evergreen”) provisions in our employment agreements. |

Shareholder’s 2015 Advisory Approval of the Corporation’s stock relative to the Russell 2000 and the SNL Index of Banks $1 - $5 Billion. The five-year total return forExecutive Compensation

At our

stock during this time was 23.73%. During the same period, the return2015 annual meeting, we held a non-binding advisory vote on the

Russell 2000 Index was 19.09% and the SNL Index of Banks $1 - $5 Billion actually had a negative return of 24.22%

| | | | | | Period Ending | | | | |

| Index | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | | | 12/31/12 | |

| First Financial Corporation | | | 100.00 | | | | 148.59 | | | | 113.77 | | | | 135.04 | | | | 131.74 | | | | 123.73 | |

| Russell 2000 Index | | | 100.00 | | | | 66.21 | | | | 84.20 | | | | 106.82 | | | | 102.36 | | | | 119.09 | |

| SNL U.S. Bank $1B-$5B | | | 100.00 | | | | 82.94 | | | | 59.45 | | | | 67.39 | | | | 61.46 | | | | 75.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

2012 Overview. In 2012 the Corporation delivered solid financial performance with net income of $32.8 million, the second highest in the history of the Corporation. This increase was in part driven by a 9.78% increase in net interest income to $108.9 million. The return on assets for 2012 was 1.13%. During 2012 the Corporation integrated its largest acquisition to date completing the purchase and assumption of Freestar Bank N.A. Also during 2012 the Corporation opened four new de novo branches in southern Indiana expanding into three new markets. The Corporation ended the year with $2.9 billion in assets. The compensation of our named executive teamofficers. This type of vote is commonly referred to as “Say-On-Pay.” At the meeting, approximately 79% of votes cast were in 2012 reflected this performance consistent withfavor of approving the compensation of our compensation philosophy discussed below.

Elements of Executive Compensation. Ournamed executive compensation system uses various elements to achieve our compensation objectives, includingofficers, down from 83% in the following:

Compensation Type | Form | Terms |

Cash | ·Salary

·Annual incentive compensation

| Salary increases are awarded as allocations from the salary pool set by the Compensation Committee and the Board

Awards are eligible to be earned upon meeting certain performance goals (net income, return on assets, return on equity, etc.)

|

Equity | ·Restricted Stock | Awards are eligible to be earned upon meeting certain 3-year average performance goals (net income, return on assets, return on equity, etc.). After earned, awards are subject to a 3-year vesting schedule.

|

Tax-Qualified Retirement

Plans

| ·Offset ESOP/

Pension Plan

| The Pension Plan provides each participant with a benefit which is offset by the benefit provided by the ESOP. To the extent the ESOP benefit is greater than the Pension Plan benefit, no Pension Plan benefit will be paid. |

Deferred Compensation | ·Executive Supplemental

Retirement Plan

·Executive’s Deferred

Compensation Plan

| The Executive Supplemental Retirement Plan and Executive’s Deferred Compensation Plan provide supplemental retirement benefits to help recompense for benefits reduced due to IRS rules under the Pension Plan and ESOP, respectively. Amounts payable under the Deferred Compensation Plan will offset amounts payable under the Supplemental Retirement Plan. To the extent the benefit under the Deferred Compensation Plan is greater than the Supplemental Retirement Plan, no Supplemental Retirement Plan benefit will be paid. |

Other | ·Perquisites | The Bank sponsors a life insurance program for the named executive officers other than Messrs. Smith and Clary.

|

Other Key Compensation Program Features | ·Clawback of incentive compensation

·No excise tax gross ups

·No automatic extension of employment agreement

·Executives share ownership guidelines

|

CEO Pay. prior year.

The Compensation Committee considered the following in determiningvote of our shareholders as a part of its review of the Corporation’s overall executive compensation program, including the appropriateness of the compensation philosophy, our objectives, and the level of compensation provided to the NEOs.

During 2015, the Committee retained Pearl Meyer & Partners, LLC, a compensation consultant with significant experience in the banking industry (“Pearl Meyer”), to assist the Committee with its review of our

Chief Executive Officer: | · | First Financial Bank N.A.’s 2012 net income was $29.9 million andexecutive compensation program. Pearl Meyer has advised the net income of the Corporation was $32.8 million. |

| · | The Bank’s Return on Assets and Return on Equity were 1.07% and 8.88% respectively. The Corporation’s Return on Assets and Return on Equity were 1.13% and 9.02% respectively. |

| · | The Corporation’s three-year average earnings per share growth rate was 14.41%. |

| · | The Corporation’s five-year total shareholder return at year end was 23.73%, 4.64% higher than the Russell 2000’s return of 19.09%. |

| · | Under the 2011 Short-Term Incentive Plan, Mr. Lowery achieved a performance level just below target. |

| · | Under the 2011 Omnibus Equity Incentive Plan, Mr. Lowery achieved a performance level above target. |

Other Executive Pay. The Compensation Committee considered the following in determining thethat our executive compensation program is generally aligned with market practice, and that total cash compensation (base salary and STIP) and total direct compensation (base salary, STIP and LTIP) of our other named executive officers:

| · | First Financial Bank N.A.’s 2012 net income was $29.9 million. |

| · | The Bank’s Return on AssetsCEO and Return on Equity were 1.07% and 8.88% respectively. |

| · | The Corporation’s three-year average earnings per share growth rate was 14.41%. |

| · | The Corporation’s five-year total shareholder return at year end was 23.73%, 4.64% higher than the Russell 2000’s return of 19.09%. |

| · | Under the 2011 Short-Term Incentive Plan, Named Executive Officers achieved a performance level just below target. |

| · | Under the 2011 Omnibus Equity Incentive Plan, Named Executive Officers achieved a performance level of maximum. |

Executive Compensation Philosophy

The Committee’s executive compensation policies are designed to attract and retain highly qualified persons as named executive officers to provide competitive levels ofare at or below the peer group median.

INTRODUCTION

This Compensation Discussion and Analysis describes the Corporation’s executive compensation program as it relates to the five executive officers (“named executive officers” or “NEOs”) included on the compensation tables beginning on page 25. For 2015, our named executive officers and to rewardtheir positions were:

Norman L. Lowery - Chief Executive Officer and President, First Financial Corporation and First Financial Bank, N.A. (our “CEO”).

Rodger A. McHargue - Chief Financial Officer, First Financial Corporation and First Financial Bank, N.A.

Norman D. Lowery - Chief Operations Officer, First Financial Corporation and First Financial Bank, N.A.

Steven H. Holliday - Chief Credit Officer, First Financial Corporation and First Financial Bank, N.A.

Karen L. Milienu - Director of Branch Banking, First Financial Bank, N.A.

The following pages describe our executive compensation philosophy, the

namedprincipal components of our executive

officers for achieving individual performancecompensation program, how our program reflects our compensation philosophy, and

for achieving performancethe roles played by different persons in establishing and evaluating the various components of

the Corporation as a whole. Additionally, the policies seek to provide a vehicleour executive compensation program. Our discussion provides important context for the

Committee to evaluatecompensation tables that follow and,

measure the performance of the Corporation and the executivestherefore, should be read in

accordanceconjunction with

the results of those

evaluations. The individual goals established in the strategic plan and budget for the Corporation and the Bank are also utilized in setting compensation levels of the named executive officers. The Committee seeks to compensate the named executive officers through a blend of both short and long-term compensation.The Compensation Committee’s Process for Setting Compensation

tables.

COMPENSATION PHILOSOPHY

The Compensation and Employee Benefits Committee (the “Committee”(“Compensation Committee”) is responsible for evaluatingdetermining our executive compensation philosophy and establishingthe establishment, implementation, and monitoring of our executive compensation levels andprogram. The Compensation Committee is composed entirely of independent Directors as determined under the rules of the NASDAQ Global Select market.

Our goal is to maintain a competitive, balanced compensation programs forprogram that rewards our named executive officers. The Committee has established a range of plans and programs which are intended to encourageofficers for current year performance and createfor the creation of long-term shareholder value, without exposing the Corporation to excessive amountsunreasonable risk, including credit, interest rate, liquidity, reputation, compliance, and transaction risk. We seek to:

Attract, motivate, and retain highly-qualified, talented executives who are focused on the long-term best interests of our shareholders;

Drive performance relative to our financial goals, balancing short-term operational objectives with long-term strategic goals;

Link the interests of our executives with those of our shareholders;

Establish corporate, departmental, and individual goals consistent with our strategic plan and budget that provide the basis for the annual and long-term metrics used to measure our success and the value that we create for shareholders;